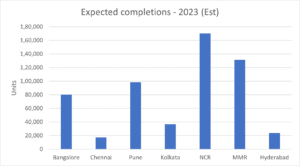

- NCR to lead the pack with approx. 1.70 lakh units – 97% increase over 2022 – to be delivered

- Housing completions in Hyderabad, with a share of just 4% of overall stock to be delivered, set to increase by 104% over 2022

- Annual completions to rise 2.8X in 2023

While 2022 set a new benchmark of residential sales, 2023 is likely to be a record year for project completions. RERA has laid down strict guidelines for project completions, mandating that that developers must complete residential projects within the timeline specified in the agreement with their customers. Project delays were historically the bane of the Indian housing sector, putting homebuyers to enormous inconveniences and often considerable, unwarranted financial strain.

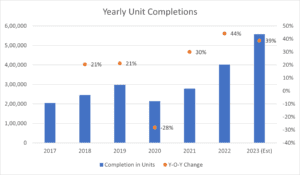

Santhosh Kumar, Vice Chairman – ANAROCK Group, says, “As per scheduled completion records, approx. 5.6 lakh homes are likely to be delivered across the top 7 cities in 2023. This is an increase of 39% over the previous year, and a major milestone as the Indian residential real estate segment crosses the 0.5 million deliveries mark for the year. From a humble volume of 2 lakh units’ completion in 2017, annual completions will rise 2.8X for 2023.”

NCR is all set to lead the pack with approx. 1.70 lakh units to be completed in 2023, accounting for an almost 30% share of the year’s the deliveries pipeline. This is a 97% hike over 2022. Coming in second is MMR which is expected to account for a 24% share. Hyderabad’s project completion share is just 4% of the top 7 cities but will notch a massive 104% increase over 2022.

Source: ANAROCK Research

Source: ANAROCK Research

|

Units Delivered |

||

|

City |

2022 |

2023 (Est) |

|

Bangalore |

48,700 |

80,100 |

|

Chennai |

21,200 |

17,400 |

|

Pune |

84,200 |

98,400 |

|

Kolkata |

23,200 |

36,700 |

|

NCR |

86,300 |

1,70,100 |

|

MMR |

1,26,700 |

1,31,400 |

|

Hyderabad |

11,700 |

23,800 |

|

PAN India |

4,02,000 |

5,57,900 |

Source: ANAROCK Research

|

Year |

Completion in Units |

|

2017 |

2,04,200 |

|

2018 |

2,46,100 |

|

2019 |

2,98,400 |

|

2020 |

2,14,400 |

|

2021 |

2,78,700 |

|

2022 |

4,02,000 |

|

2023 (Est) |

5,57,900 |

Source: ANAROCK Research

Apart from the stringent RERA rules, developers have other compelling reasons to meet their project completion targets:

- Better cash flows enable smoother construction: Increased sales volume, indicating an uptick in housing demand, has led to better cashflows which allow developers to focus on completing their projects.

- Managing input costs: Input costs are rising incessantly, and developers already operate on very slim profit margins. Project delays result in even higher input costs.

- AIFs aiding project completions: Several alternate investment funds funding cash-positive stuck projects are also adding to the high volume of completions. Since its inception in 2019, the SWAMIH Fund provided final approval to 130 projects cumulatively valued at INR 12,000 crores and enabling the completion of 20,557 housing units.

- Tech-enabled construction techniques: For many years, the Indian construction sector used conventional construction methodologies and processes. The advent of cost-effective and efficient technologies has changed the scenario. Approx. 66% of Indian construction companies are now prioritizing digital transformation.

Despite the optimistic anticipation of a new project completions benchmark in 2023, there are some factors that can challenge it. For instance, the prevailing uncertainty in the global economy owing to geopolitical conflicts, and potentially untamed inflation, can result in huge cost increases. Nevertheless, India’s leading real estate developers have risen above all odds in the past 2-3 years – this new project completion record seems attainable.

“This content is provided by the company and the website will not be responsible in any way for the content of this article.”