Author: Eve Pope, Technology Analyst at IDTechEx

Major CCUS (carbon capture, utilization, and storage) players converged in Houston, Texas, in the last week of June for the 2024 iteration of the Carbon Capture Technology Expo North America. Co-located with the Hydrogen Technology Expo, the event boasted over 8000 attendees and 400 exhibitors – including IDTechEx. To complement IDTechEx’s CCUS portfolio, presentations were attended, and exhibition booths were visited that were relevant to carbon capture technologies, the carbon dioxide removal space, and the utilization of captured carbon dioxide in enhanced oil recovery and sustainable fuels. In this article, IDTechEx explores three key CCUS insights from the event.

1. The world’s largest direct air capture facility won’t be used for fossil fuels

In a talk from Robert Zeller (Vice President of Technology at Oxy Low Carbon Ventures) at the Expo, it was revealed that the CO2 captured from Stratos – Occidental Petroleum’s large-scale direct air capture (DAC) facility – will not be utilized for the extraction of fossil fuels. The company stated that consumer demand instead lies in dedicated geological storage of carbon dioxide.

Carbon capture has long been coupled with a process involving permanently injecting CO2 into depleted oil reservoirs to stimulate more production, known as enhanced oil recovery (EOR). For many decades, this was the only economically viable business model for CCUS, predating climate concerns and carbon pricing. About 75% of all carbon dioxide currently captured today is used for this purpose.

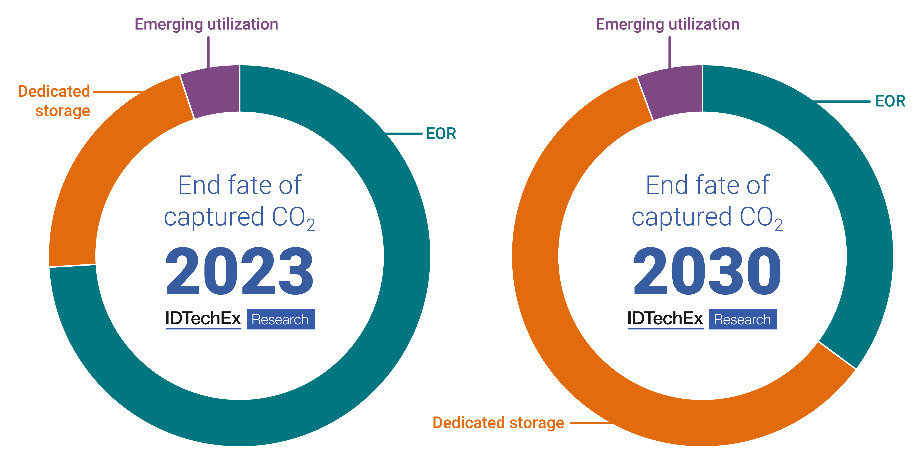

The prevalence of EOR has allowed CO2 pipeline transport infrastructure and geological storage expertise to flourish while simultaneously enabling the production of oil with a lowered carbon footprint, but such strong links to fossil fuels have made CCUS and DAC controversial for some environmentalists. Occidental’s intent to geologically sequester CO2 without EOR, instead generating revenue from voluntary carbon removal credits, illustrates that future CCUS business models will no longer rely on fossil fuels. IDTechEx forecasts that dedicated geological storage will outstrip EOR as the leading end fate of captured carbon dioxide by 2030.

IDTechEx forecasts that dedicated geological storage will outstrip EOR as the leading end fate of captured carbon dioxide by 2030. Source: IDTechEx

It is an exciting time for direct air capture, with Climeworks’ Mammoth facility starting operations in May 2024. Currently the biggest DAC facility in existence, this plant is capable of removing 36,000 tonnes per year of CO2 directly from the atmosphere. However, a new king is set to be crowned in 2025, with the planned launch of Stratos. Stratos will propel direct air capture to new heights by capturing and permanently sequestering 500,000 tonnes per annum of CO2. The solvent-based DAC approach that will be used was developed by Carbon Engineering (acquired by Occidental in 2023 for US$1.1 billion).

It is no secret that direct air capture requires large amounts of energy, but Stratos will not be run on fossil fuels. Occidental plans to enable new clean energy infrastructure to be built in parallel with all its future DAC projects. For Stratos, a solar farm is being built via an agreement with Origis Energy. Zeller also expressed Occidental’s interest in nuclear fusion technology for this purpose once the field reaches maturity.

2. Carbon capture technologies are essential for the development of a hydrogen economy

The Carbon Capture Technology Expo and Hydrogen Technology Expo are co-located for good reason. About 100 megatonnes of hydrogen will be produced this year from fossil fuels. By retrofitting existing facilities with CCUS technologies or building greenfield facilities specifically designed to incorporate carbon capture, CO2 capture technologies could play a key role in scaling up the hydrogen economy. Hydrogen produced in this way is called blue hydrogen.

Talks from Mitsubishi Heavy Industries, Air Liquide, and Honeywell UOP at the Carbon Capture Technology Expo North America highlighted the wide range of carbon capture technologies suitable for blue hydrogen production at the mega-scale. Selection of the most appropriate technology depends upon several factors, including the hydrogen production technology deployed (commonly steam methane reforming, autothermal reforming, or partial oxidation), flue gas impurities present, solvent management restraints, and space demand. Amine solvent-based technologies dominated discussions due to the maturity of this approach, with cryogenic technologies also being popular due to the relatively high purity of CO2 in the flue gas stream.

Although green hydrogen production (H2 made via renewable powered electrolysis of water) is a more sustainable long-term solution than blue hydrogen production, large-scale green hydrogen projects are likely to remain prohibitively expensive until the mid-2030s. In contrast, blue hydrogen production uses mature ready-now technologies. Blue hydrogen can be viewed as a complimentary and transitionary technology to green hydrogen, enabling new hydrogen supply chains and infrastructure to be developed as the costs of electrolyzers decrease and renewable electricity becomes widely deployed.

The demand for blue hydrogen production could be quite significant in a decarbonized global future. However, questions still remain for blue hydrogen. Economic incentives for blue hydrogen project developments remain uncertain in several regions. Faster action is required to create demand for low-emission hydrogen and unlock investment.

3. Fuels made from CO2 are seeing demand from the aviation and shipping sectors

Since the energy densities of battery technologies are too low for full electrification of the aviation and maritime sectors to be feasible, sustainable fuels represent the most viable decarbonization pathway. Fuels made using captured CO2 and low-carbon hydrogen is one promising approach.

In the past, alternative fuels have struggled to thrive due to an inability to achieve price parity with fossil fuels. However, increasing demand for such fuels (including CO2-derived fuels) will soon be driven by regulation. For example, ReFuelEU Aviation Regulation was adopted by the European Union in 2023, mandating a 70% sustainable aviation fuel blending obligation by 2050. The EU ETS was extended to the maritime sector in 2024, covering CO2 emissions from all large ships. Regulatory pressure will continue to increase over the next few decades, providing significant opportunities for CO2-derived fuels once these technologies are demonstrated at scale.

Many alternative fuels will be required for net zero, but a large supply gap currently exists. As Jenna Pike, senior scientist at OxEon Energy, stated in her Expo presentation, market size is not the limitation for CO2-derived fuels but rather the ability to deliver at the large scales required. Current challenges include difficulties sourcing and transporting captured CO2 and the high costs associated with low-carbon hydrogen.

Approaches to decarbonization must be practical

Meaningful decarbonization can only happen if transitionary technologies are embraced. Some criticize CCUS for extending the lifetime of fossil-fuel-based industrial emissions. However, while “business as usual” concerns are not without cause, the transition to greener alternatives will not happen overnight. CCUS can decarbonize existing assets while green infrastructure develops, providing decarbonization in the interim. Approaches to decarbonization must be practical – and the perfect should never be the enemy of the good.

More information

For information on:

- the entire CCUS value chain, see the IDTechEx report Carbon Capture, Utilization, and Storage (CCUS) Markets 2025-2045: Technologies, Market Forecasts, and Players.

- direct air capture, see the IDTechEx report Carbon Dioxide Removal (CDR) 2024-2044: Technologies, Players, Carbon Credit Markets, and Forecasts.

- CO2 utilization, see the IDTechEx report Carbon Dioxide Utilization 2024-2044: Technologies, Market Forecasts, and Players.

- blue hydrogen, see the IDTechEx report Blue Hydrogen Production and Markets 2023-2033: Technologies, Forecasts, Players.

For the full portfolio of energy and decarbonization market research available from IDTechEx, please visit www.IDTechEx.com/Research/Energy. Downloadable sample pages are available for all IDTechEx reports.