Author: Sam Dale, Senior Technology Analyst at IDTechEx

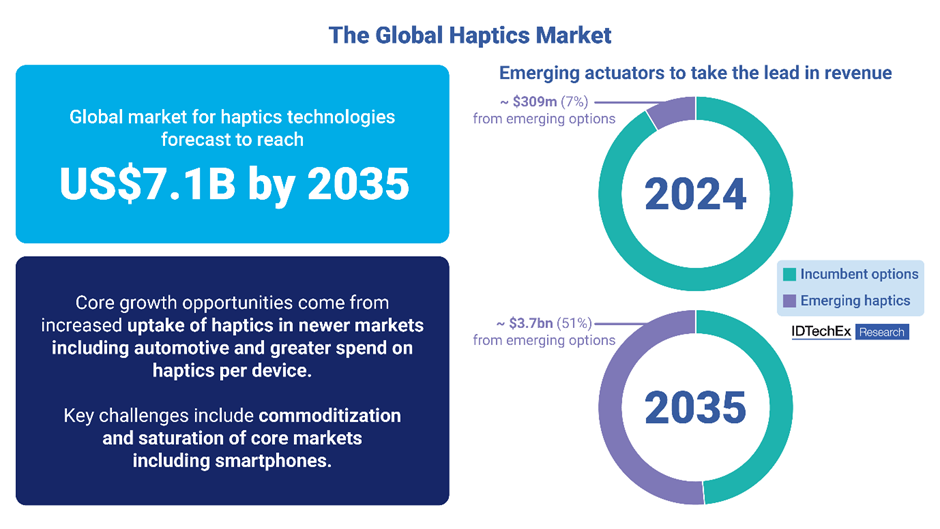

The capabilities of haptic feedback technologies have grown far beyond adding rumble to game controllers or silent notifications to cellphones. IDTechEx’s new report, “Haptics 2025-2035: Technologies, Markets, Players”, predicts the market for haptics technologies to reach US$7.1B by 2035, representing a CAGR of 4.4% from 2024 to 2035. This is expected to be chiefly driven by growing adoption of haptics in non-traditional markets, particularly vehicle interiors, as well as increasing spend on haptics per device across many segments as manufacturers look to improve the quality of haptic response as well as the number of actuation points.

The global haptics market. Source: IDTechEx

Most haptic implementations fall under the banner of tactile feedback, which simulates surface texture, typically using vibrational motion. The activators that generate this are a key area of innovation – these shape experiences that include input confirmation and replacing physical buttons to enable immersive, tactile experiences in virtual reality. The most recent major shift in this area has been the rise of LRAs (Linear Resonant Actuators). These provide a “clickier” and more configurable haptic response than ERM (Eccentric Rotating Mass) motors they are widely replacing, since they accelerate faster and decouple frequency from amplitude.

In 2024, further shifts are underway, with the use of surface haptics in applications, including automotive displays, growing and more emerging activator technologies, including VCMs (voice coil motors) and piezoelectric haptics, growing their market shares. Innovation has also taken place in other classes of haptics. Kinesthetic (force) feedback has widened with the deployment of Adaptive Triggers in Sony’s gaming controllers since the launch of the PS5. Thermal haptics offers another emerging dimension of tactile experience in the earlier stages of adoption; Italian startup WeART has blazed the trail here, recently releasing its second generation of haptic gloves featuring thermal haptics alongside other classes of haptic feedback to provide a full haptic experience.

WeART’s gloves are often paired with VR headsets to provide more immersive experiences. In terms of haptic innovation, the VR accessory market is important due to the development of advanced haptic wearables, even if its overall value is comparatively small. Innovation in activator design and the use of more activators per device to increase the level of feedback or replace more functions are key factors behind the overall trend of increased spending on haptics per relevant device. These are trends that arguably began in this market sector but are expected to spread more widely over the coming decade.

Smartphones have long been the most lucrative market for haptic technologies, representing 47% of the overall market in 2023, with the need for alerts and keyboard feedback meaning that virtually every smartphone contains a haptic activator, but the smartphone market is at saturation. Opportunities still abound, however. Apple introduced the haptic home button to the iPhone range way back in 2016 with the iPhone 7, using the device’s Taptic Engine (a specialized LRA) to simulate a solid-state button clicking. Haptic buttons are back in the latest iPhone 16 after a 6-generation hiatus, with two capacitive buttons being used to add a DSLR-like camera button feel and control mute and other functions. Haptic buttons are expected to provide a major source of growth within the smartphone industry in terms of increasing spend per device, with emerging actuator options, particularly piezoelectric, being good options here.

Adoption of haptic feedback in new areas will be the other major growth driver. This is particularly true of its growing use in vehicle cockpits, where haptics perform roles from safety alerts to replacing physical buttons that control key driving functions. However, although haptic features have been adopted by many automakers, including Tesla, Hyundai, and Chrysler, feedback is not uniformly positive. VW recently abandoned haptic buttons in vehicle interiors, citing customer experience concerns. Adoption of newer actuator types may be one way that a premium experience could be delivered here, helping to convince consumers that solid state buttons are more than a cost-saving measure.

IDTechEx’s new report, “Haptics 2025-2035: Technologies, Markets, Players”, explores these narratives and much more. It includes forecasting and market overviews, which focus on key application areas, including smartphones, automotive, gaming, VR, laptops, and other wearables, are informed by extensive primary interviews, with over 30 company profiles included with this report. IDTechEx has been covering this market since 2015, and its network and overview of this exciting market is extensive. This report is a must for those who need to understand the changing dynamics of this complex marketplace, charting its course over the next decade and beyond.

To find out more about this IDTechEx report, including downloadable sample pages, please visit www.IDTechEx.com/Haptics.

For the full portfolio of sensors, displays, and haptics market research available from IDTechEx, please see www.IDTechEx.com/Research/Sensors.

Upcoming free-to-attend webinar

Good Vibrations: The Future of the Haptics Market

Sam Dale, Senior Technology Analyst at IDTechEx and author of this article, will be presenting a free-to-attend webinar on the topic on Thursday 17 October 2024 – Good Vibrations: The Future of the Haptics Market.

The webinar will include:

- Overview of the major haptic actuator technology choices

- Exploration of haptics technology innovations and developments

- Highlighting expected stories in the haptics market for the next ten years

- Adoption roadmaps for haptics technology

We will be holding exactly the same webinar three times in one day. Please click here to register for the session most convenient for you.

If you are unable to make the date, please register anyway to receive the links to the on-demand recording (available for a limited time) and webinar slides as soon as they are available.