Author: Dr Tess Skyrme, Senior Technology Analyst at IDTechEx

The headlines have been full of exciting announcements about new brain-computer interface technologies that can read our minds. This data could be used in place of phone touch screens or computer mice to decode our speech and perhaps even control wheelchairs or drive cars. Much of the media’s attention is drawn to Elon Musk’s Neuralink, the company developing an invasive, wireless ‘brain-chip’. However, the fate of the brain-computer market is far less tied to this specific company than many may appreciate.

In this article, IDTechEx will outline the competition Neuralink is facing from not only other invasive brain computer interface developers but also from the more established eco-system of non-invasive solution providers. More information on all of the players and technologies covered in this article, alongside twenty-year market forecasts, can be found in IDTechEx’s latest report on the brain computer interface market.

Invasive solutions: It’s not all about Neuralink

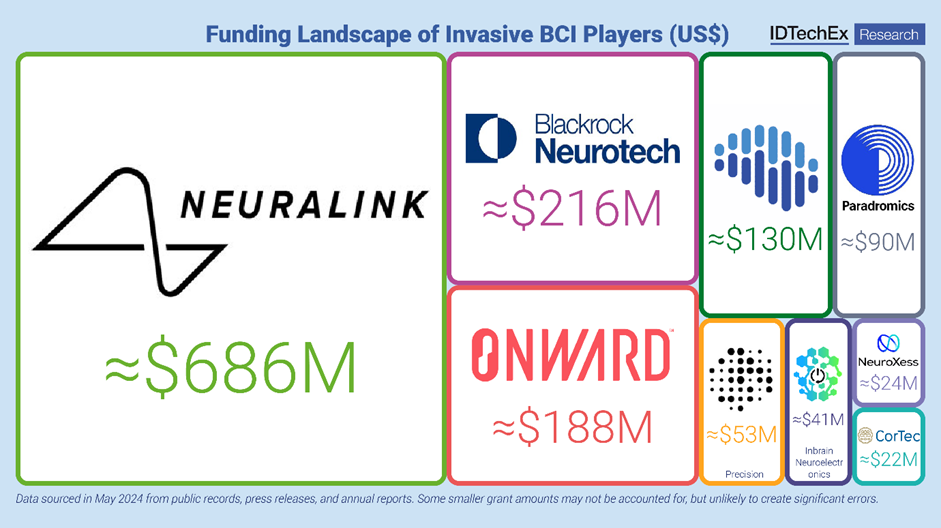

Over the last decade, a range of companies have been founded seeking to develop invasive brain-computer interface solutions. Indeed, comparatively, Neuralink (founded in 2016) has been late to the party – following players such as Blackrock Neurotech (2008), Synchron (2012), Onward Medical (2014), and Paradromics (2015). But this eco-system has been thrust further into the spotlight in more recent years as their funding levels have risen, with almost USD$1.5B now split amongst the leading players.

Funding landscape of invasive BCI players (US$). Source: IDTechEx

On the one hand, most players are proposing approaches designed to overcome some key challenges with many existing neural interfaces. This includes increasing implant longevity to omit the need for repeat surgeries and minimizing damage to brain tissue. This runs in parallel with a need for the use of softer and more biocompatible materials. Furthermore, many existing interfaces are produced to stimulate the brain rather than solely measuring neural signals, and as such, optimizing next-generation designs to maximize the signal-to-noise ratio is also critical. Finally, increasing the channel count (or number of electrodes) is also part of the value proposition for many BCI developers.

However, while many of these players are reacting to the same brief – their responses vary significantly. For example, Neuralink is seeking to overcome the barriers presented by dependence on specialist surgeons by pioneering the development of a specialist robot to implant high numbers of ultra-fine electrodes into the brain. Meanwhile, Blackrock continues to improve on the now established Utah array to develop a more flexible and ultra-high channel count product. These two leaders also differ (publically, at least) in their prioritization of offering entirely wireless solutions.

Others in the space argue that reducing invasiveness is of higher value. This includes Onward Medical, who are pursuing the ECoG (electrocorticography) approach, which sees sensors sit within the skull but only contact the surface of the brain. Yet their system is very different again from Synchron’s, whose stentrodes are designed to lace the inside of blood vessels.

The years ahead will see many players ramp up their clinical trial activity, and the efficacy of these various BCI approaches in humans will all truly be put through their paces. As they do, we may see more partnerships and influence from the role of advanced material specialists rise in prominence. This is evidenced by recent spin-out and start-up activity, such as Axoft, who have developed a perfluoropolyether-based dielectric material 10,000 times softer than conventional stiff plastic encapsulation.

Overall, it’s not all about Neuralink. Looking ahead, the pressure is mounting on many players to deliver on offering improved quality of life to those demographics in real need of successful invasive BCIs integrated into assistive technology solutions for communication, mobility, and social inclusion.

Non-invasive solutions for the next generation of wearables

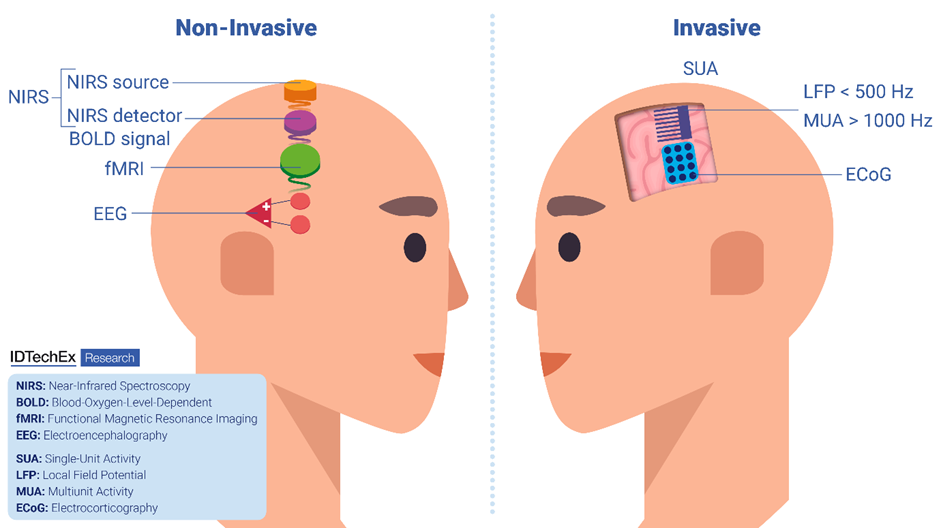

Given the extent of the hype surrounding invasive BCIs, it is easy to overlook the importance of their non-invasive counterparts. Don’t forget that neuroscience research has utilized electrode-integrated EEG (electroencephalography) caps for decades to measure and use brain signals for a variety of applications, including demonstrations of wheelchair control, cursor control, and speech decoding.

In the past, bringing EEG capabilities out of the lab has been prohibited by the dependence on wet gels to improve conductance between the skin surface and the electrode. This has been particularly challenging for wearers with longer hair. Yet innovations in dry electrode technologies are now beginning to unlock the consumer market.

Products from the likes of Datwyler (the soft pulse electrode) and IDUN Technologies (the Dryode) have been used to demonstrate how EEG can be integrated without the use of gels into wearables such as crowns, virtual reality headsets, and even headphones/earphones.

An overview of the major non-invasive and invasive methods of brain-computer interfacing. Source: IDTechEx

In fact, developers for the wearable technology market are now offered a choice of many sensing modalities to measure neural signals – including optical sensors to measure responses to brain activity in the blood and even magnetic field sensors for biomagnetic imaging.

That being said, there is a well-known problem with the issues of noise and motion when trying to implement non-invasive BCI in the ‘real world’ using wearables. Not to mention the challenge of persuading mass-market consumers to adopt a headset-style device. Indeed, these are still important barriers to adoption in the market, but there are drivers suggesting the established status quo could be set to shift.

The continued miniaturization of compute, now combined with the rise of AI, makes the data-processing and noise-cancelling solutions available on the edge far more advanced. Moreover, as the adoption of VR headsets and perhaps smart glasses becomes more socially acceptable, the opportunity to add non-invasive BCI capabilities for hands-free control also becomes more compelling. Even Apple has patented a design for EEG-enabled air pods.

Overall, there is little doubt that the quality of data that is measurable non-invasively will unlikely rival what is possible to obtain with invasive devices. Yet despite this, solutions are emerging that can satisfy ease of use while also providing actionable neural activity data. There is already evidence of this in the next generation of hearables, which can provide neural feedback to music and optimize playlists for a better night’s sleep.

IDTechEx expects the next few years to be fairly critical in determining if consumer device control will really include non-invasive BCI solutions or if the technology will remain routed in research and emotional state monitoring markets.

Market outlook

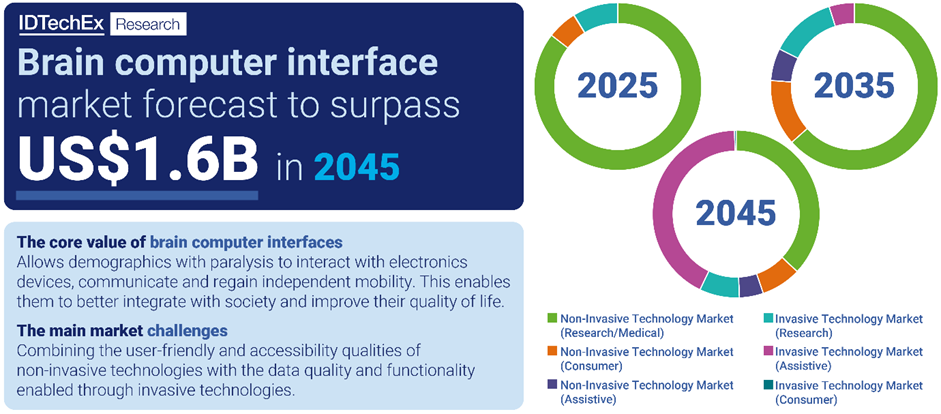

Ultimately, IDTechEx predicts that there will be an evolving opportunity for both non-invasive and invasive technologies across the next twenty years, with the overall brain computer interface market forecast to grow to over USD$1.6bn by 2045. We anticipate that the market for non-invasive solutions will grow before the commercialization of invasive solutions from players such as Neuralink. However, the long-term opportunity within the assistive technology market is more likely to be captured by the likes of Elon Musk. Yet, at this stage, the floor is open not only for Neuralink but also for its many and growing list of competitors.

The brain computer interface market. Source: IDTechEx

IDTechEx’s latest report on the brain computer interface market analyses the major technologies, players, applications and challenges. This includes coverage across non-invasive and invasive technologies, comparisons across key technical benchmarks, and market forecasts from 2025 to 2045. There is also detailed coverage of supply chain innovations impacting this market, including coverage of the wearables sensors market, such as dry-electrodes, photo-detectors, and magnetic field sensors, including technologies from the quantum sensors market.

For the full portfolio of wearable technology market research available from IDTechEx, please see www.IDTechEx.com/Research/WT. Downloadable sample pages are available for all IDTechEx reports.