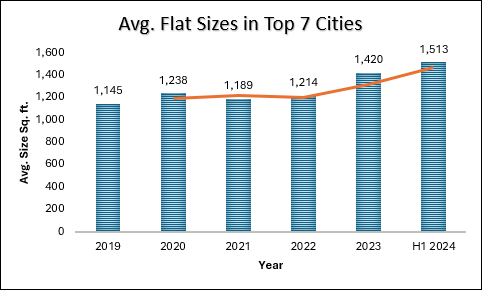

- Avg. flat sizes in the top 7 cities increased from 1,145 sq. ft. in 2019 to 1,513 sq. ft. in H1 2024

- NCR sees maximum growth in avg. flat sizes – from 1,250 sq. ft. in 2019 to 2,450 sq. ft in H1 2024 – due to increased new luxury supply

- Among top 7 cities, avg. flat size in NCR is highest, followed by Hyderabad with 2,010 sq. ft.; unsurprisingly, MMR has least avg. flat size

- MMR also sees least change (of 5%) in avg. flat sizes – from 784 sq. ft. in 2019 to 825 sq. ft. in H1 2024

- Yearly trends of average flat sizes in top 7 cities indicate that H1 2024 saw a 7% annual rise; avg. size in 2023 stood at approx. 1,420 sq. ft.

Despite a significant jump in residential prices across the major cities, bigger homes continue to attract homebuyers. Latest ANAROCK research indicates that average flat sizes in the top 7 cities grew by 32% in the last five years – from 1,145 sq. ft. in 2019 to 1,513 sq. ft. in H1 2024.

In 2023, the average flat size across the top 7 cities was 1,420 sq. ft. – indicating a 7% jump in the last six months alone.

A deep-dive into data from the top 7 cities shows that NCR saw the highest growth – a staggering 96% – in average flat size in the last five years: from 1,250 sq. ft. in 2019 to 2,450 sq. ft. in H1 2024.

Santhosh Kumar, Vice Chairman – ANAROCK Group, says, “This significant jump in NCR’s average flat size is largely due to the increased new supply of luxury apartments in the last one year. Developers here are responding to the higher demand for spacious luxury homes with appropriate supply.”

This is significant, considering that affordable housing previously dominated NCR’s supply. In fact, affordable segment supply in NCR has been declining steadily in the last few years.

“As expected, MMR saw the least growth in the average flat sizes in this five-year period,” says Santhosh Kumar. “The average flat size in MMR rose from 784 sq. ft. in 2019 to 825 sq. ft. in the first half of 2024 – a mere 5%. In this five-year period, only 2020 saw a notable 21% annual rise in the region’s average flat size against 2019. Since 2020, the average size here was the highest in 2022 – at 840 sq. ft. It fell by 5% in 2023 against the preceding year.”

Among the top 7 cities, NCR overtook Hyderabad to record the highest average flat size of 2,450 sq. ft. in H1 2024. In Hyderabad, it was 2,010 sq. ft.

- Average flat sizes in the other major southern cities – Chennai and Bengaluru – are 1,450 sq. ft. and 1,630 sq. ft. respectively in H1 2024.

- Kolkata’s average flat size stands at 1,125 sq. ft. while in Pune, it is 1,103 sq. ft.

While 5-year trends indicate a significant jump in flat sizes across cities because of the pandemic-specific demand profile, the rise on a half-yearly basis highlights this continued consumer preference – despite life returning to normalcy and prices rising across cities.

Besides seeing the highest rise of 96% in average flat size in the last five years, NCR has also recorded the highest rise in the last six months. They rose by 30% – from 1,890 sq. ft. by 2023-end to 2,450 sq. ft. in H1 2024, essentially due to the increased new supply in the luxury segment in this period.

Of approx. 24,300 units launched in NCR in H1 2024 across different budget segments, luxury homes comprised the maximum share of 77% – approx.18,600 units.

City Highlights

An analysis of the five-yearly trend of average flat sizes in the top 7 cities shows a rise of over 32% – from 1,145 sq. ft. in 2019 to 1,513 sq. ft. in H1 2024. In the last six months alone, average flat sizes rose by 7% jump, with Hyderabad the only city to see flat sizes decrease in this half-year period.

- In NCR, the average flat size increased by 96% in the last five years – from 1,250 sq. ft. in 2019 to 2,450 sq. ft. in H1 2024. In the last six months, avg. sizes increased by 30% in the region. In 2023, the avg. flat size here was 1,890 sq. ft. In both periods, NCR saw the highest jump among the top 7 cities.

- In Hyderabad, the average flat size increased by 18% in this five-year period – from 1,700 sq. ft. in 2019 to 2,010 sq. ft. in H1 2024. Contrastingly, between 2023 and H1 2024, Hyderabad is the only city to see the average flat size decrease – by 13%.

- Bengaluru saw a 27% five-yearly jump in avg. flat size – from 1,280 sq. ft. in 2019 to 1,630 sq. ft. in H1 2024. Between 2023 and H1 2024, the city saw average flat sizes increase by 10%.

- In Kolkata, the avg. flat size increased by 13% in five years – to 1,125 sq. ft. in H1 2024 from 1,000 sq. ft. in 2019. In 2023, the avg. flat size here was 1,124 sq. ft.

- In Pune, the avg. flat size saw a 21% five-yearly increase – to 1,103 sq. ft. in H1 2024 from 910 sq. ft. in 2019. In the last six-months period, there has been a mere 1% jump in avg. flat sizes in the city.

- Chennai saw a 32% jump in avg. flat sizes in the last five years – from 1,100 sq. ft. in 2019 to 1,450 sq. ft. in H1 2024. In the six-months period, there has been a 15% jump.

- In MMR, avg. flat sizes continue to be the lowest among the top 7 cities – at 825 sq. ft. in H1 2024. However, there has been a 5% increase in H1 2024 against 2019, when it stood at 784 sq. ft. In the six-months period, the region saw avg. flat sizes see a 4% yearly increase.